How to Open a US Bank Account for Paraguay Tax Residents

Authored by Paraguay Expert

Table of Contents:

- Why open a US bank account as a Paraguay Tax Resident

- How to open a US bank account as a Paraguay Tax Resident

- Why use Grabr Fi as a Paraguay Tax Resident?

- FAQ About Opening a US Bank Account in Paraguay

Paraguay Tax Residency is ideal: you pay 0% on foreign income and stay compliant while you travel around the world. This option is the most convenient tax residency solution for digital nomads and location-free entrepreneurs. Finally, if you're wondering if you can open a personal USD checking bank account as a Paraguay Tax Resident, the answer is now YES!

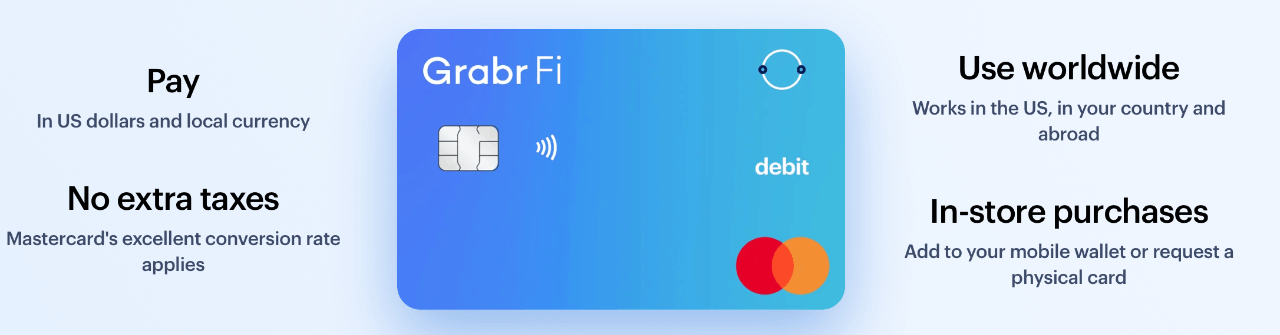

The visadb.io team has found a solution for our community: Grabr Fi. This modern solution helps people worldwide, including Paraguay, open a real US bank account without setting foot in the US or Paraguay. With just your phone and a few documents, you access a fully functional USD account, virtual and physical debit cards, and more.

In this guide, learn how to open a US bank account from Paraguay with Grabr Fi, the benefits and requirements, and why it might be your best banking solution.

Why open a US bank account as a Paraguay Tax Resident

Grabr Fi welcomes users from Paraguay, including Paraguay tax residents, and provides a fully digital experience to open and manage your USD account.

Why Grabr Fi is a convenient option for Paraguay Tax Residents:

✈️ No need to travel.

🇺🇸 No need for a US address, visa, or SSN.

🛂 No need to be a US citizen or resident.

🧾 Receive payments from anywhere, platforms like PayPal, Upwork, or Deel.

🪪 Sign up process in minutes. Meet the ID and verification requirements

💳 Hold and spend in USD. No more worrying about exchange rates.

📲 Forget paperwork. Everything, from sign-up to support, happens inside the Grabr Fi app.

The solution is especially attractive if you:

- Earn income in USD (freelancing, remote work, etc.)

- Need to receive payments from platforms like Upwork or Fiverr

- Want to save money in USD against inflation

How to open a US bank account as a Paraguay Tax Resident

Step 1:

Sign up for Grabr Fi here. You can also download the app. Available for iOS and Android.

Step 2:

Have your Paraguay Cedula and Tax ID ready to verify your identity. Fill in basic contact information and possibly take a selfie for verification.

Step 3:

Meet the ID and verification requirements. Take less than 5 minutes.

Voilá!

Once approved, you receive:

- A US account number and routing number

- A virtual debit card

- The option to order a physical debit card to use worldwide 🌍

- Transfer funds from other bank accounts or services like Wise or Payoneer.

Note: A human will manually review your application if not immediately approved.

Why use Grabr Fi as a Paraguay Tax Resident?

#1 Licensed & Regulated

Grabr Fi partners with Piermont Bank, a US-based, FDIC-insured bank. That means your funds are protected up to $250,000, just like any traditional US bank account.

#2 Serious Security

Includes features like two-factor authentication (2FA), bank-grade encryption, and real-time transaction alerts.

#3 Global Community, Local Support

Grabr Fi serves thousands of users across Latin America and has built a reputation for reliable service, transparent fees, and responsive support.

#4 No Hidden Fees

Unlike many traditional banks, Grabr Fi keeps its fees super clear. There are no surprise maintenance charges or sketchy fine print.

Grabr Fi is secure, legit, and built for freelancers, digital nomads, and remote entrepreneurs who acquired their Paraguay Tax Residency.

FAQ About Opening a US Bank Account in Paraguay

Here are some of the most frequently asked questions about Grabr Fi:

1. Can I receive USD payments with Grabr Fi?

Yes! Grabr Fi provides a US account and routing numbers, like a regular US bank account. Receive and send payments in USD from clients, employers, or platforms.

2. Is there a minimum deposit to open an account?

There is no minimum deposit to open your Grabr Fi account. Fund it however and whenever works best for you.

3. What are the fees for Grabr Fi?

Grabr Fi is transparent with its fees. No monthly maintenance fees for your account. There is a small fee for international ATM withdrawals or currency exchanges. Always check the app for up-to-date fee details.

4. How long does it take to get my physical card?

You get a virtual debit card instantly after signing up. The physical card takes 7–14 business days to be delivered. It depends on your location.

Paraguay Tax Residents no longer have to find ways to access the US banking system.

So, should you open a Grabr Fi account?

If you are looking for convenient, low-cost banking that works for Paraguay Tax residents, Grabr Fi is worth considering. Open your account today here.

Related Blogs

Panama Tax Residency Guide for Digital Nomads

Read the essential requirements for obtaining temporary residency in Panama, including financial proofs, documents, and application tips.

AI Bookkeeping for Small Businesses [Complete Guide 2024]

This guide explains how AI helps small businesses manage and optimize bookkeeping, the benefits, the disadvantages of traditional bookkeeping and AI tools.

Paraguay Tax Residency Complete Guide 2025

How to get Paraguay tax residency, temporary and permanent residence in Paraguay in 2025 as a digital nomad or expat, a complete fiscal and immigration guide.

What is a Tax Residency and Why it is Important

We explore what is a Tax Residency and Why it is Important for digital nomads, expats, and remote entrepreneurs to have one.