Opening a Remote LLC in Wyoming as a Digital Nomad

Authored by visadb.io

Table of Contents:

- Why do entrepreneurs from around the world choose to register their businesses in the United States?

- What are the best states for entrepreneurs to register a business in the United States?

- What are the top benefits of registering an LLC in Wyoming as a foreigner?

- What is the tax rate for an LLC in Wyoming for a digital nomad?

- How do you register an LLC in Wyoming?

- Can you also get access to business credit if you are a foreigner with a Wyoming LLC?

- Do you have to visit Wyoming to open a company there?

- How much is it to register an LLC in Wyoming with visadb.io?

- What about taxes on dividends regarding Wyoming LLC?

- If I already earned money this year before opening a Wyoming LLC can I still funnel the funds through it?

- Does this help with getting a US residency?

- Can I get a business bank account as a foreigner in the United States?

Are you a digital nomad looking for a country where to register your business? There are many options available, and Wyoming LLC is one of the most popular ones. Here you can find the answer to the most common questions by location-free entrepreneurs when it comes to opening a remote LLC in Wyoming as a digital nomad.

Why do entrepreneurs from around the world choose to register their businesses in the United States?

In recent years, online entrepreneurs and e-commerce startups have been registering their businesses in the United States.

- It is the biggest and richest market and if you want to access it, an American company is the best option.

- The law protects you from liability and there are also many privacy laws for your LLC.

What are the best states for entrepreneurs to register a business in the United States?

If you are from the United States, it is usually much easier and cheaper to register in your home state.

If you are a digital nomad, Wyoming is an incredible option because it has cheap quotes for business formation and a quick setup system. Find here a comprehensive option to register your Wyoming LLC without any hassle.

If you think your company will get venture capital or private equity financing, Delaware and Nevada are your best options.

Fun fact: LLC (Limited Liability Company) was invented in Wyoming in 1978.

What are the top benefits of registering an LLC in Wyoming as a foreigner?

- Entrepreneur Protection: Their legal system is incredibly simple and protective of the entrepreneur. If you get sued, vetted, or have problems, they will not take over your private property. They can only go after the resources of your LLC.

- Tax Benefits: Wyoming has no corporate income tax. You just need to have a registered agent with an address in Wyoming and submit an annual report which is a one or two-page document.

- Loans and Grants: Many states offer grants, so you can take advantage of them by registering a US corporation.

Wyoming is overall a welcoming state for foreigners. You can hire someone here to help you open your business and submit your annual reports.

What is the tax rate for an LLC in Wyoming for a digital nomad?

Unless you go to Wyoming and open a physical office and sell to Wyoming residents, you will NOT have to pay any local taxes. Wyoming also has a 0% corporate income taxation. So, if your business is digital, you are not liable for taxes.

In any case, we also recommend that you consult an accountant or a verified agent, to make sure that the nature of your business is no exception and be aware of any other possible government fees.

How do you register an LLC in Wyoming?

The whole process can be done online in about five to ten minutes. You simply have to fill in the online form: enter your company name, owners' names, and addresses. After two or three business days, the LLC can be registered.

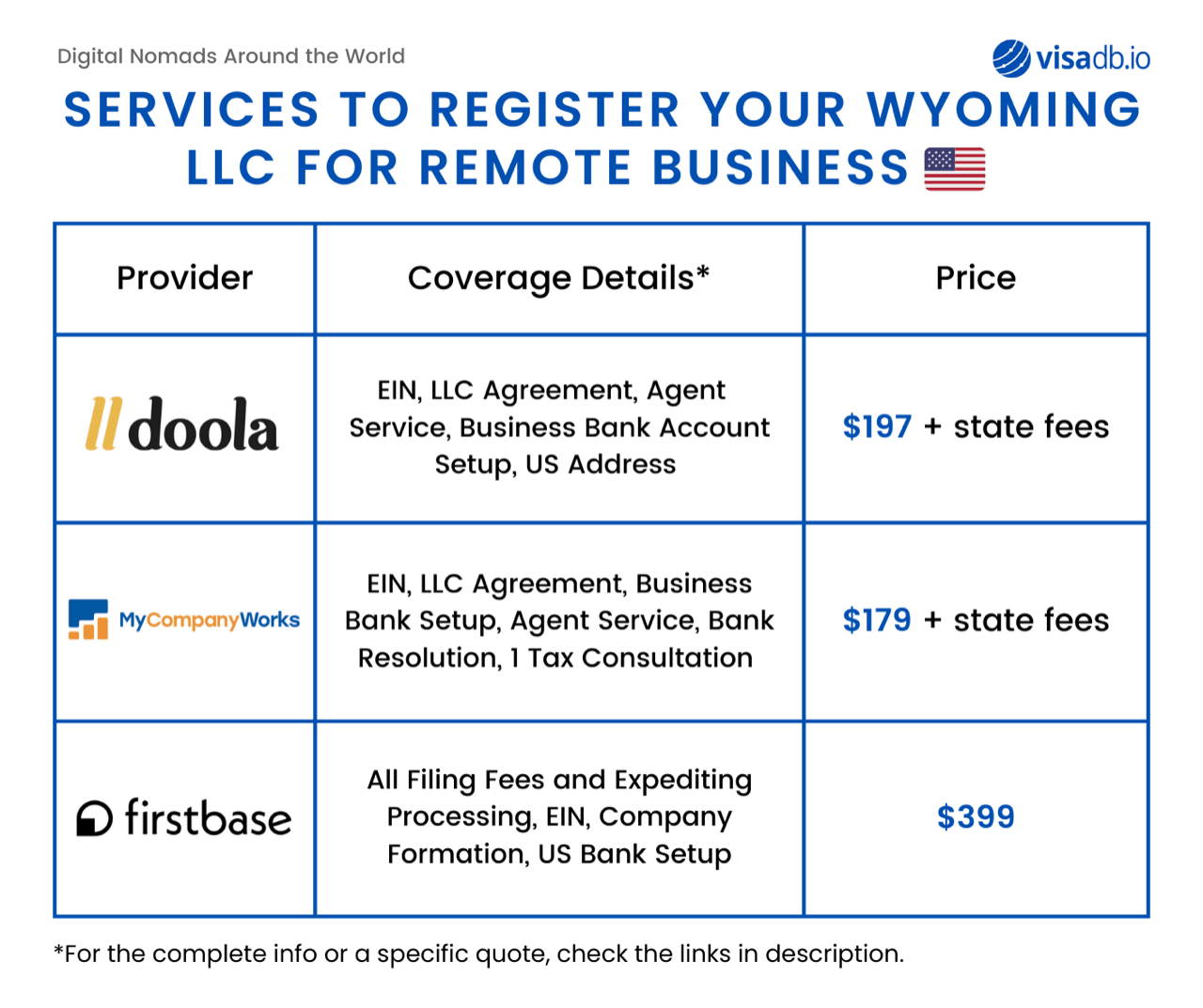

Community-verified options to register an LLC in Wyoming:

OPTION 1: Our first option for a community-verified LLC registration expert has a team in Wyoming that goes to the Wyoming Secretary of State to register your LLC. This is an excellent, careful, and comprehensive service. Start today here.

OPTION 2: You can also get remote professional assistance for as little as $197 here. It includes registered agent services for a whole year: a really good deal.

Can you also get access to business credit if you are a foreigner with a Wyoming LLC?

It can be difficult as a brand-new company because basically, you do not have a credit history.

You can also check out some Credit Options like Mercury’s Credit Card for LLCs.

Do you have to visit Wyoming to open a company there?

No, you can do the whole process 100% remotely.

How much is it to register an LLC in Wyoming with visadb.io?

You can get priority service with our partners. Packages start at $58.

The first one includes company formation, Tax ID, and agent service and is $179 USD. Fill out their form here.

The second one includes company formation, Tax ID, assistance to open a bank account, registered agent service for a year, and a virtual mailbox for $197 USD + state fees. You can start the process here.

You can also get an excellent and comprehensive package with Firstbase, here.

What about taxes on dividends regarding Wyoming LLC?

Dividends for an LLC are called distributions and are simply the money you take from the company and give to yourself. Since the LLC is a pass-through entity, there is no tax on the business, it only goes to you and whatever your income is, you will have to pay tax on your tax residency country.

If I already earned money this year before opening a Wyoming LLC can I still funnel the funds through it?

Yes, just have them updated on the contract and amend the contract. You also need to have them pay you as your LLC.

However, if you already earned money directly from your personal account, it is more convenient that you do not move it anymore.

Does this help with getting a US residency?

There are some visas available that allow you to use your existing LLC to show the Immigration Authority that you have an active business and that you need to visit the United States. It can facilitate your process, but it really only helps your case and is not 100% a decision-maker to get a residence permit or visa.

Can I get a business bank account as a foreigner in the United States?

Yes, you can apply for a business bank account in 10 to 15 minutes with financial technologies like Mercury Bank. You will need to upload your ID e.g. passport, and company number.

Remember that visadb has your back during your nomad relocation and business endeavors. Watch the whole session with Matt and Danish about registering a Wyoming LLC below.

Related Blogs

How to Open a US Bank Account for Paraguay Tax Residents

Learn how Paraguay residents can easily open a personal US checking bank account without visiting the US or Paraguay to send or receive international USD payments.

Panama Tax Residency Guide for Digital Nomads

Read the essential requirements for obtaining temporary residency in Panama, including financial proofs, documents, and application tips.

AI Bookkeeping for Small Businesses [Complete Guide 2024]

This guide explains how AI helps small businesses manage and optimize bookkeeping, the benefits, the disadvantages of traditional bookkeeping and AI tools.

Paraguay Tax Residency Complete Guide 2025

How to get Paraguay tax residency, temporary and permanent residence in Paraguay in 2025 as a digital nomad or expat, a complete fiscal and immigration guide.