Residence, Territorial or Citizenship based taxation

Authored by Danish Soomro

Table of Contents:

Have you ever wondered if you have a Residence, Territorial or Citizenship based taxation? In this article, you can get a general idea about the different types of taxation. This is mainly relevant for you if you are a digital nomad or location-free entrepreneur.

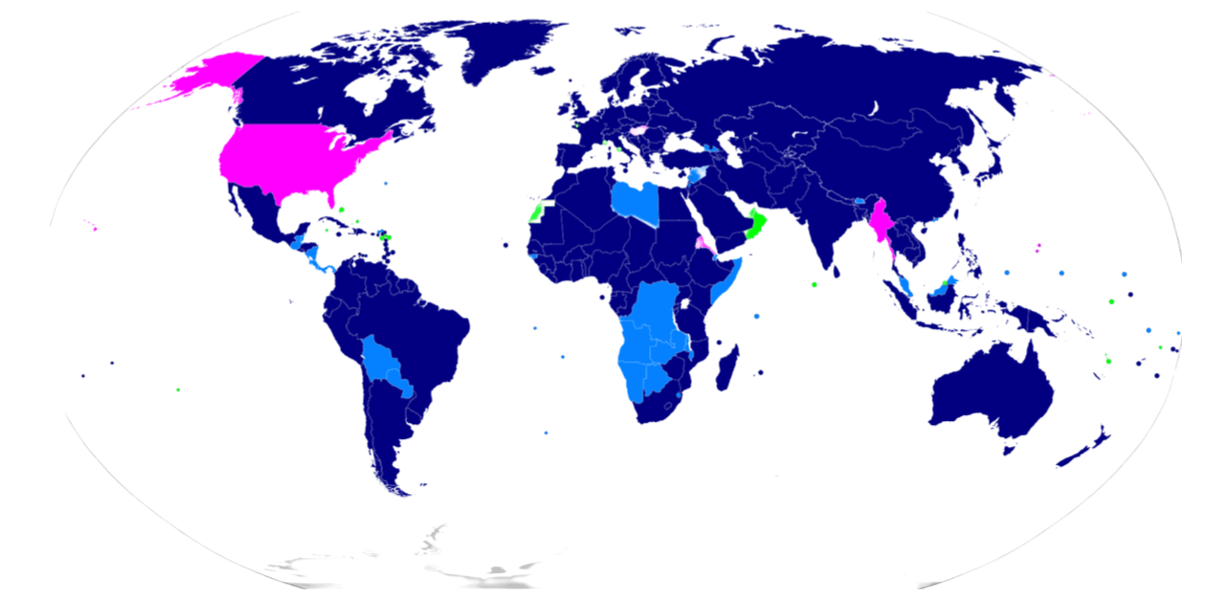

CHECK OUT THE IMAGE BELOW TO SEE WHO USES WHAT SYSTEM OF TAXATION SO YOU CAN PLAN YOUR TAX PROJECT

Countries have the following kinds of taxation*:

- No Income Tax on Individuals

- Territorial Taxation (on local income of individuals)

- Residence-based taxation (tax on local income of individuals, and on foreign income of residents)

- Citizenship-based taxation (tax on local income of individuals, on foreign income of residents, and on foreign income of nonresident citizens)

*This is a general guide. Each country may as well have its exceptions.

Countries that tax income generally use one of two systems:

Territorial Tax System

- The territorial tax system only takes taxes on domestic income, or income derived from sources located within the nation.

- Residents of the nation pay taxes on their worldwide (local and foreign) income under the residence-based system, while usually nonresidents only pay taxes on their local income.

- In some cases, a small number of nations also tax their citizens who are not residents of those countries on their worldwide income.

- Regardless of the taxpayer's residence, territorial systems typically tax local income.

- The main issue raised in opposition to this kind of system is the ease with which portable income can be moved outside of the nation without being taxed. Governments have responded by implementing hybrid systems to make up for lost revenue.

Residence-based Tax System

- The tax that residents already pay to other countries on their foreign income is typically deductible or refundable in countries that levy taxes based on residence.

- In order to avoid or minimize double taxation on things like income taxes, inheritance taxes, value-added taxes, and other taxes, many nations also sign tax treaties with one another.

- Most jurisdictions base income taxation on residency. They must first define "resident," which is typically defined by the 183-day rule, before characterizing the income of nonresidents.

- The location of the taxpayer's primary residence and the length of time the taxpayer has been physically present in the nation (183 days) are typically considered in these definitions, which vary by country and type of taxpayer.

Personal & business tax reduction/residency advice for digital nomads

Citizenship-based tax system

In the vast majority of countries, citizenship is completely irrelevant for taxation. Very few countries tax the foreign income of nonresident citizens in general:

- The United States: The same tax rates that apply to residents are applied to the worldwide income of US citizens who are non-residents. Nonresident citizens may exclude a portion of their foreign employment income from US taxes in order to reduce double taxation, US taxation and claim a credit for income taxes paid abroad, but they are required to submit a US report even if there is no tax liability, you must still file a tax return to claim the exclusion or credit.

- Hungary: Except for those who hold a different nationality, Hungary treats all of its nonresident citizens as tax residents.

- France: France taxes its citizens, as well as residents in Monaco, as French residents.

- Italy: continues taxing its citizens who move from Italy to a tax haven.

Related Blogs

How to Open a US Bank Account for Paraguay Tax Residents

Learn how Paraguay residents can easily open a personal US checking bank account without visiting the US or Paraguay to send or receive international USD payments.

Panama Tax Residency Guide for Digital Nomads

Read the essential requirements for obtaining temporary residency in Panama, including financial proofs, documents, and application tips.

AI Bookkeeping for Small Businesses [Complete Guide 2024]

This guide explains how AI helps small businesses manage and optimize bookkeeping, the benefits, the disadvantages of traditional bookkeeping and AI tools.

Paraguay Tax Residency Complete Guide 2025

How to get Paraguay tax residency, temporary and permanent residence in Paraguay in 2025 as a digital nomad or expat, a complete fiscal and immigration guide.