Top 3 Digital Nomad Insurance Options for 2023

Authored by Digital Nomads Around the World

Table of Contents:

- Is there special travel insurance for digital nomads?

- How does health insurance differ from travel insurance?

- Frequently Asked Questions about SafetyWing, Nomad Insurance

- How much is SafetyWing Insurance?

- What is the medical coverage provided by Nomad Insurance through SafetyWing?

- What type of travel coverage is provided by Nomad Insurance from SafetyWing?

- What kind of support coverage is offered by Nomad Insurance?

- Which countries are covered by SafetyWing’s Nomad Insurance?

- Does SafetyWing cover me if I have an accident on a scooter?

- Are young children covered by SafetyWing's Nomad Insurance?

- Pros of SafetyWing Nomad Insurance

- Cons of SafetyWing Nomad Insurance

- Frequently Asked Questions about InsuredNomads

- How much is InsuredNomads?

- What does World Explorer Multi offered by InsuredNomads include in terms of medical coverage?

- What type of travel coverage is provided by InsuredNomads' World Explorer Multi?

- Does InsuredNomads offer coverage for adventure sports and activities?

- Does InsuredNomads cover COVID-19-related medical expenses?

- Pros of InsuredNomads World Explorer Multi

- Cons of InsuredNomads World Explorer Multi

- Frequently Asked Questions about WorldNomads

- What does the medical coverage offered by WorldNomads?

- What does the travel coverage offered by WorldNomads?

- Does World Nomads cover COVID-19?

- Can I purchase World Nomads insurance after I have already left for my trip?

- Pros of WorldNomads Travel Insurance

- Pros of WorldNomads Travel Insurance

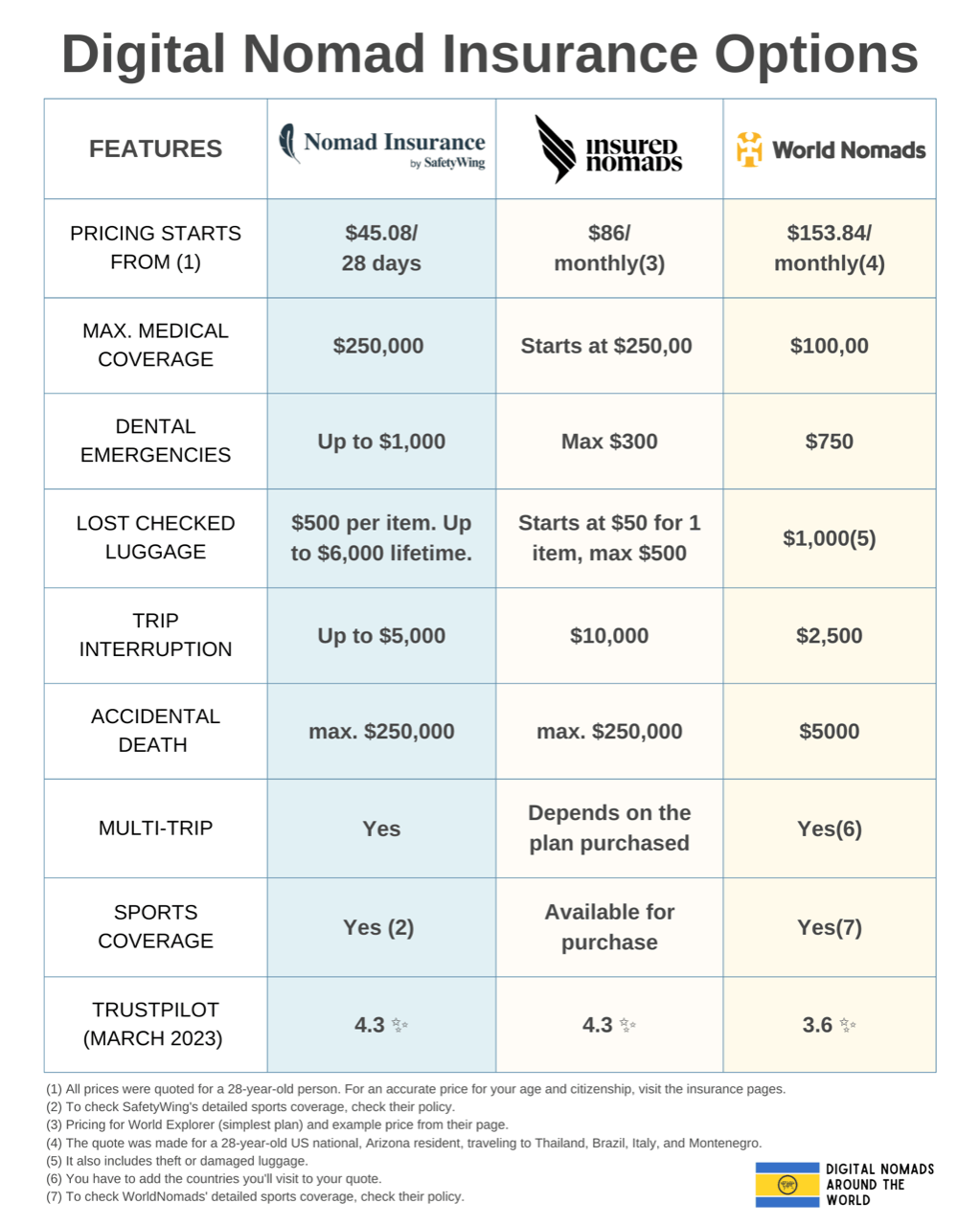

- Nomad Insurance Options Comparison Chart

When traveling around the world, digital nomads must prioritize securing adequate travel insurance to look after their health and finances.

Let us start with the basics of travel insurance for digital nomads:

Is there special travel insurance for digital nomads?

Given that numerous digital nomads are self-employed or work as independent contractors, standard insurance policies may not cover them.

Therefore, it is important to select an insurance provider that offers plans specifically designed for the digital nomad lifestyle.

How does health insurance differ from travel insurance?

While health insurance provides coverage for routine medical check-ups and treatments, travel insurance offers protection against unforeseen incidents that may occur while traveling.

The amount of coverage required depends on a variety of factors, such as one's risk tolerance, destination, participation in high-risk activities, desire to have children, pre-existing medical conditions, and others.

Please note that the purpose of this article is to assist the digital nomad community in selecting an appropriate insurance plan. The information provided is a summary and is intended for this purpose only. For additional details, please contact the relevant insurance companies directly.

Option #1: SafetyWing

SafetyWing is highly popular in the digital nomad community due to its affordable worldwide coverage and inclusive policy for individuals of all nationalities, which was designed by and for nomads.

Their Nomad Insurance is an excellent option, offering global travel medical coverage for emergencies. They also offer a Remote Health plan specifically tailored for a higher comprehensive experience for full-time nomads.

Read on to discover all the essential details about these highly recommended insurance options or see more on their page here.

Frequently Asked Questions about SafetyWing, Nomad Insurance

How much is SafetyWing Insurance?

Pricing for SafetyWing's Nomad Insurance: $45.08/28 USD for 28days***

*Starts at $45.08 USD per 4 weeks/28 days for people from 10 to 39 years old.

**US Travel involves extra charges.

What is the medical coverage provided by Nomad Insurance through SafetyWing?

Nomad Insurance offered by SafetyWing is available for purchase in 180 countries and provides coverage for up to 30 days at home following 90 days spent abroad. It also offers access to a network of qualified medical professionals, including doctors, hospitals, and emergency medical evacuation services.

- Deductible: $250 USD

- Maximum coverage for medical emergencies: $250,000 USD

- Dental emergencies coverage: Up to $1,000 USD

- Hospital and nursing rooms

- Intensive care up to the overall maximum limit

- Ambulance when covered illness or injury results in hospitalization

- $50 USD daily in physical therapy and chiropractic care (if requested by a doctor)

- See the rest of the medical coverage here.

What type of travel coverage is provided by Nomad Insurance from SafetyWing?

The Nomad Insurance Plan from SafetyWing offers support in case of accidents or illness during your travels abroad.

- Travel Interruption Coverage: Up to $5,000 USD

- Travel Delay Coverage: Up to $100 USD for an unexpected overnight for a maximum of 2 days.

- Lost checked luggage: $3,000 USD in lost checked luggage per certificate period; $500 per item; and $6,000 USD lifetime for lost checked luggage

- Natural Disaster Coverage: $100 USD per day for 5 days if you find yourself in a natural disaster

- Political Evacuation: up to $10,000 USD lifetime

- Medical Emergency Evacuation: up to $100,000 USD lifetime

- Coverage of $25,000 USD lifetime maximum for personal liability

- $25,000 USD for overall Accidental Death & Dismemberment

- See the rest of the travel coverage here.

What kind of support coverage is offered by Nomad Insurance?

Nomad Insurance provides a 24/7 support service.

Which countries are covered by SafetyWing’s Nomad Insurance?

SafetyWing provides coverage for travel in any country outside of your home country, except for those that are under sanction. The company adheres to sanctions imposed by the US, UK, EU, and UN.

Does SafetyWing cover me if I have an accident on a scooter?

If you happen to have an accident while riding a motorbike, moped, or scooter, don't worry - SafetyWing got you covered for your eligible medical expenses, as long as you have a valid license for the area you are driving in and you are wearing proper safety gear, for example, a helmet.

Just make sure you are not driving under the influence or racing, as these are not covered. Please note that personal liability for operating any vehicle is not covered.

It is always a good idea to check with the local authorities to make sure your driver's license is accepted in the area, state, or country you are visiting.

Are young children covered by SafetyWing's Nomad Insurance?

Yes, the insurance covers up to two children between 14 days and 10 years of age per family at no additional cost, making it an ideal insurance choice for nomad families.

Pros of SafetyWing Nomad Insurance

✔️ Buy anytime during your trip

✔️ Include two children under 10 at no cost

✔️ COVID-19-related medical expenses, including testing, treatment, and quarantine costs

✔️ Purchase online in just a few minutes, without the need for any medical exams or paperwork

Extra Pro Tip: Join through our community Digital Nomads Around the World link for quicker support.

Cons of SafetyWing Nomad Insurance

❌ It does not cover pre-existing conditions, routine checkups, or dental care.

Option #2: InsuredNomads

InsuredNomads offers technology-focused solutions that are perfect for digital nomads. If you're a tech-savvy nomad, you will appreciate their insurance options where you can add mental health and electronic equipment coverage.

Take a look at the key features of each plan below, designed specifically for global citizens.

Frequently Asked Questions about InsuredNomads

How much is InsuredNomads?

InsuredNomads has several plan options. World Explorer Multi is a travel medical insurance plan that nomads can use to be covered both for travel mishappens and medically. InsuredNomads' World Explorer Multi needs a quotation according to your needs. Get yours here.

What does World Explorer Multi offered by InsuredNomads include in terms of medical coverage?

This particular plan provides coverage for all essential aspects of short-term trips abroad.

- Emergency medical expenses and repatriation for up to $1,000,000 USD

- Accidental death (18 through 69 - $25,000 USD)

- Telemedicine

- The deductible is $250 USD

- See complete coverage here.

What type of travel coverage is provided by InsuredNomads' World Explorer Multi?

World Explorer Multi plan offered by InsuredNomads is designed to cover the following for your trip.

- Lost checked luggage for $50 USD for one item, $250 USD maximum

- Political evacuation and repatriation for $10,000 USD

- Trip Interruption for $5,000 USD

- See complete coverage here.

Does InsuredNomads offer coverage for adventure sports and activities?

Yes, InsuredNomads offers coverage for a wide range of adventure sports and activities, including bungee jumping, scuba diving, and skiing.

Does InsuredNomads cover COVID-19-related medical expenses?

Yes, InsuredNomads offers coverage for COVID-19-related medical expenses, including testing, treatment, and quarantine.

Pros of InsuredNomads World Explorer Multi

✔️ User-Friendly Application Process: The application process for InsuredNomads is straightforward and can be completed online.

✔️ InsuredNomads offers flexible coverage options, allowing travelers to customize their policy to fit their specific needs.

✔️ InsuredNomads provides coverage for travelers worldwide, including trips to high-risk countries with the plan World Explorer Hotspot.

Cons of InsuredNomads World Explorer Multi

❌ While InsuredNomads does not typically cover pre-existing conditions, there may be exceptions to this policy that you can clarify through consultation.

❌ Telemedicine is only available in the US.

Option #3: WorldNomads

World Nomads aims to enhance your travel experience by providing smarter and safer travel insurance. Their policies are tailored to cover your essential trip needs, and any unforeseen emergencies that may arise. It is important to note that coverage may vary depending on the country of residency of the insured.

See below to discover more about WorldNomads.

Frequently Asked Questions about WorldNomads

What does the medical coverage offered by WorldNomads?

- Dental emergency expenses are covered in all WorldNomads policies, including unexpected infections, broken teeth, and jaw or mouth injuries.

- Medical emergency coverage includes hospitalization, outpatient treatment, prescribed medication, X-rays, and laboratory tests.

- Back-home transportation is covered if required due to a medical emergency.

- WorldNomads offers 24-hour multilingual coverage, including guidance to the nearest hospital and payment assistance.

- Both the Standard and Explorer plans provide coverage of $100,000 USD.

- See complete coverage here.

What does the travel coverage offered by WorldNomads?

- Stolen passports and IDs.

- Delayed or lost luggage and they provide coverage for essential items unless your baggage is recovered within 12 hours.

- Trip cancellation coverage is also available, with the Standard plan covering up to $2,500 USD and the Explorer plan covering up to $10,000 USD.

- Tech gear is also covered by the Standard plan for $1,000 USD and the Explorer plan for $3,000 USD.

- See complete coverage here.

Does World Nomads cover COVID-19?

Yes, World Nomads does provide coverage for COVID-19-related medical expenses as long as you become sick during your trip. It is important to note that policies purchased after the pandemic was declared may have exclusions related to COVID-19. Additionally, trip cancellation coverage due to COVID-19-related travel restrictions may not be included in all policies.

Can I purchase World Nomads insurance after I have already left for my trip?

Yes, you can purchase World Nomads insurance even if you have already left for your trip. Depending on your country of residence and your travel destination, some coverage may be limited or not available.

Pros of WorldNomads Travel Insurance

✔️ Tech Coverage: WorldNomads offers a range of travel insurance plans that cover teach gear.

✔️ Flexibility: WorldNomads policies are flexible and can be customized to suit your specific travel needs. They allow you to choose the level of coverage that best suits you, and you can also extend your coverage if you decide to extend your trip.

✔️ Accessibility: WorldNomads policies are available to travelers from over 140 countries, and you can purchase coverage even if you are already traveling. They also have a 24/7 customer service team available to answer any questions or concerns.

Pros of WorldNomads Travel Insurance

❌ WorldNomads insurance policies can be more expensive than some other travel insurance providers, especially if you require a high level of coverage.

❌ Limited Coverage for Extreme Sports: WorldNomads policies may not provide coverage for certain extreme sports, such as bungee jumping or skydiving unless you purchase an additional rider.

As a digital nomad, you have the freedom to work from anywhere in the world, but you also need to be prepared for any unforeseen circumstances that may arise during your travels.

Nomad Insurance Options Comparison Chart

Each of these digital nomad insurance options has its unique advantages and disadvantages, but all three can provide peace of mind for digital nomads who want to focus on their work and travel adventures without worrying about the unexpected. Whether you choose SafetyWing, World Nomads, or InsuredNomads, you can rest assured that you have the coverage you need to enjoy your digital nomad lifestyle to the fullest.

If you would like to see other options besides these three, get a free quote for Cigna, GeoBlue, IMG, or SevenCorners here.

Related Blogs

Travel Light and Smart: 7 Essential Items for Digital Nomads

Find the 7 essential items digital nomads cannot forget to pack to travel light and smart on their next trip with tips from the largest community.

$5 E-SIM to Do SMS Verification Hack for Digital Nomads

With Tello's $5 eSIM, you can stay connected globally with an affordable alternative to Skype. Read how to get a $5 E-SIM to do SMS Verification Hack for Digital Nomads.

How to pack like a digital nomad

Travel experts from the largest online community shared seven hacks to teach you how to pack like a digital nomad, optimize space, and carry the essentials.

The Philippines for Digital Nomads [Guide 2023]

Learn everything you need to know about The Philippines for Digital Nomads in our Guide 2023 including basic information and checklist.