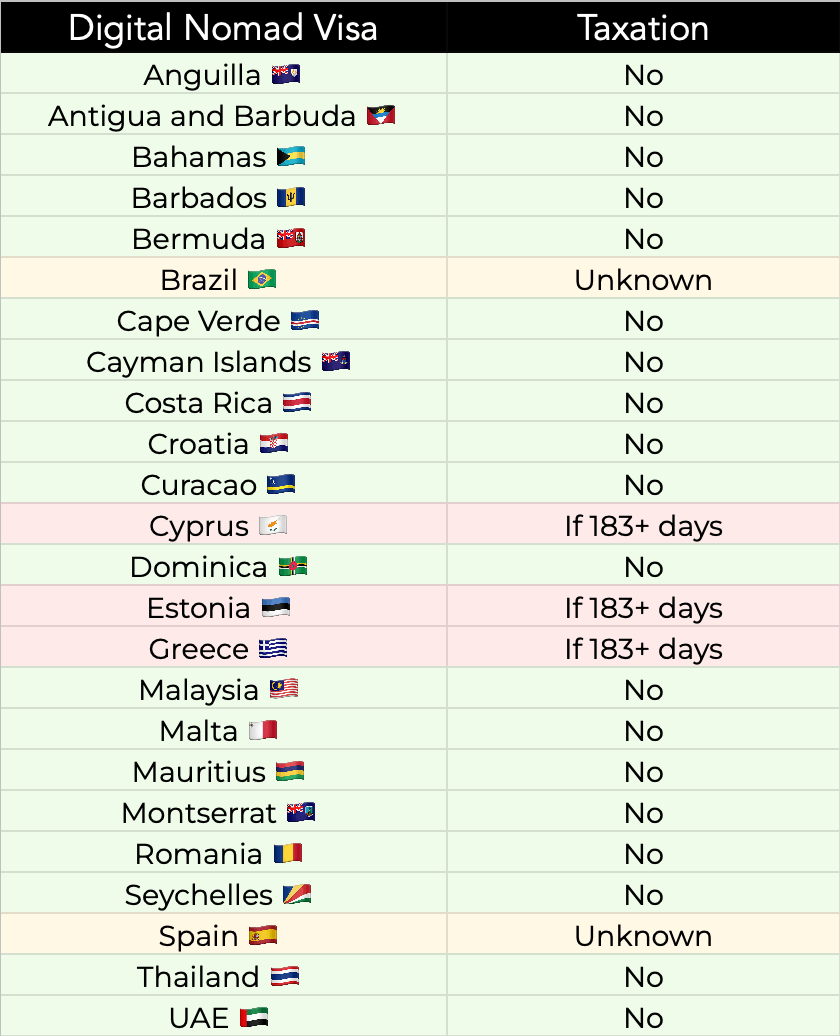

Which digital nomad visas make you a tax resident

Authored by Paula Vazquez

Table of Contents:

- Do I pay taxes with the Anguilla Digital Nomad Visa?

- Do I pay taxes with the Antigua and Barbuda Digital Nomad Visa?

- Do I pay taxes with the Bahamas Digital Nomad Visa?

- Do I pay taxes with the Barbados Digital Nomad Visa?

- Do I pay taxes with the Bermuda Digital Nomad Visa?

- Do I pay taxes with the Brazil Digital Nomad Visa?

- Do I pay taxes with the Cape Verde Digital Nomad Visa?

- Do I pay taxes with the Cayman Islands Nomad Visa?

- Do I pay taxes with the Costa Rica Digital Nomad Visa?

- Do I pay taxes with the Croatia Digital Nomad Visa?

- Do I pay taxes with the Curacao Digital Nomad Visa?

- Do I pay taxes with the Cyprus Digital Nomad Visa?

- Do I pay taxes with the Dominica Digital Nomad Visa?

- Do I pay taxes with the Estonia Digital Nomad Visa?

- Do I pay taxes with the Greece Digital Nomad Visa?

- Do I pay taxes with the Malaysia Digital Nomad Visa?

- Do I pay taxes with the Malta Digital Nomad Visa?

- Do I pay taxes with the Mauritius Digital Nomad Visa?

- Do I pay taxes with the Montserrat Digital Nomad Visa?

- Do I pay taxes with the Romania Digital Nomad Visa?

- Do I pay taxes with the Seychelles Digital Nomad Visa?

- Do I pay taxes with the Spain Digital Nomad Visa?

- Do I pay taxes with the Thailand Digital Nomad Visa?

- Do I pay taxes with the UAE Digital Nomad Visa?

Taxation regimes and laws are particularly burdensome for digital nomads. When you apply for a digital nomad visa, it might be confusing when you become a tax resident, and therefore acquire obligations. In this article, you can find which digital nomad visas make you a tax resident in the country and which ones, on the contrary, have tax benefits and perks.

Note that in this article we only manage OFFICIAL DIGITAL NOMAD VISAS, to say, visas that were specifically created for remote workers and digital nomads, and not those that could be used as well e.g. Freelancer visas.

Disclaimer: We recommend that you hire a verified tax expert, as this information is not official tax advice. Even if you are not liable to taxation under some digital nomad visas, you might still be required to pay taxes in your home country.

Do I pay taxes with the Anguilla Digital Nomad Visa?

No. In Anguilla, a British Overseas Territory, direct taxes such as personal income tax, corporate income tax, and capital gains tax do not exist as it is considered a tax-neutral jurisdiction. So, if you have successfully been granted an Anguilla Digital Nomad Visa, you do not have to pay taxes.

Do I pay taxes with the Antigua and Barbuda Digital Nomad Visa?

No. As long as you do not work for an Antigua and Barbuda business, you are not required to pay personal income taxation with the Digital Nomad Visa.

Do I pay taxes with the Bahamas Digital Nomad Visa?

No. As a digital nomad in the Bahamas, you will not be liable to pay income or capital gain taxes.

Do I pay taxes with the Barbados Digital Nomad Visa?

No. You will not be subject to double taxation as you will not be required to pay income tax in Barbados with their Digital Nomad Visa.

Do I pay taxes with the Bermuda Digital Nomad Visa?

No. You do not have to pay personal income tax if your income is from abroad.

Do I pay taxes with the Brazil Digital Nomad Visa?

This information is still unclear to the Brazilian authorities. We recommend that you talk to a verified immigration agent to ask about any doubts you have.

Brazil Digital Nomad Visa Application Service

Do I pay taxes with the Cape Verde Digital Nomad Visa?

No. As a remote worker in Cape Verde, you do not have to pay income tax.

Do I pay taxes with the Cayman Islands Nomad Visa?

No. The Cayman Islands is a British Overseas Territory and is known for being a tax-neutral jurisdiction, meaning that there is no direct taxation such as personal income tax, corporate income tax, or capital gains tax. Therefore, under the Cayman Islands Digital Nomad Visa or not, you would pay income tax.

Colombia Digital Nomad Visa - Documents Review Service

Do I pay taxes with the Costa Rica Digital Nomad Visa?

No. You will not be required to pay income taxes. Additionally, if you import vehicles, computers, or other technological equipment into Costa Rica, you will not be subject to any taxes.

Costa Rica Digital Nomad Visa Application

Do I pay taxes with the Croatia Digital Nomad Visa?

No. If you applied for a Croatia Digital Nomad Visa and got a successful result, you do not have to pay any taxes for your job in Croatia.

Application for the Croatian Digital Nomad Visa

Do I pay taxes with the Curacao Digital Nomad Visa?

No. You do not become a resident with the Curacao Digital Nomad Visa, and therefore you do not need to pay taxes on personal income.

Do I pay taxes with the Cyprus Digital Nomad Visa?

Maybe. If you live in Cyprus for a total of 183 days or more, or for a number of periods whose sum exceeds 183 days, you will be considered a tax resident of Cyprus. So, if you exceed 183 days living there under the Cyprus Digital Nomad Visa, you will have to pay taxes.

Do I pay taxes with the Dominica Digital Nomad Visa?

No. If you have a Dominica Digital Nomad Visa, you are exempt from paying income taxes, capital gains taxes, and dividend taxes.

Do I pay taxes with the Estonia Digital Nomad Visa?

Depends. If you reside in Estonia for 183 days or more over a 12-month period, you will be considered a tax resident of Estonia and will be required to declare and pay taxes, even if your Digital Nomad Visa has been approved.

Do I pay taxes with the Greece Digital Nomad Visa?

Depends. If you stay less than 6 months, you do not have to pay taxes, but after that you do. You can get a 50% reduction on your tax payments as a digital nomad.

Digital Nomad Visa for Greece Assistance

Do I pay taxes with the Malaysia Digital Nomad Visa?

No. If your work is located outside of Malaysia and you have a Digital Nomad Visa, you do not have to pay taxes.

Malaysia Digital Nomad Visa Application Assistance

Do I pay taxes with the Malta Digital Nomad Visa?

No. During your entire stay under the Nomad Residence, you will not be obligated to pay income tax.

Digital Nomad Residency for Malta - Remote Application

Do I pay taxes with the Mauritius Digital Nomad Visa?

No. If your income is earned abroad and you make a declaration, you will not be subject to taxes. However, any income you receive from sources within Mauritius will be subject to taxation. Additionally, depositing funds into a bank account in the country may also make you liable for taxes.

Premium Visa in Mauritius

Do I pay taxes with the Montserrat Digital Nomad Visa?

No. You do not have to pay income taxes in Montserrat as a digital nomad with the Remote Worker Stamp.

Do I pay taxes with the Romania Digital Nomad Visa?

No. As long as you have tax residency in another country, you will not be required to pay taxes in Romania.

Do I pay taxes with the Seychelles Digital Nomad Visa?

No. With the Seychelles Workcation Retreat Program, you do not pay income taxes and customs duty on work equipment.

Do I pay taxes with the Spain Digital Nomad Visa?

The digital nomads will be subject to the IRNR (non-resident income tax) instead of the IRPF (personal income tax). This tax is typically intended for individuals who do not reside in Spain for more than 183 days. However, the recent changes in laws make it easier for digital nomads to continue to be under this tax regime.*

*Even though this information is from a government source, it is yet to be liable for changes. We will be updating this page.

Do I pay taxes with the Thailand Digital Nomad Visa?

No. Thailand has more than one visa that Digital Nomads can apply for, however, if we talk about the Remote Workers LTR, no, you do not have to pay taxes on overseas income.

Digital Nomad Visa Thailand

Do I pay taxes with the UAE Digital Nomad Visa?

No. One of the benefits of the Work Remotely from Dubai permit is that you are exempt from paying taxes in the United Arab Emirates.

It is important for digital nomads to be aware of their tax obligations and to consult with a tax professional to ensure compliance with local tax laws. We hope this article helps you kickstart your planning.

Related Blogs

How to Open a US Bank Account for Paraguay Tax Residents

Learn how Paraguay residents can easily open a personal US checking bank account without visiting the US or Paraguay to send or receive international USD payments.

Panama Tax Residency Guide for Digital Nomads

Read the essential requirements for obtaining temporary residency in Panama, including financial proofs, documents, and application tips.

AI Bookkeeping for Small Businesses [Complete Guide 2024]

This guide explains how AI helps small businesses manage and optimize bookkeeping, the benefits, the disadvantages of traditional bookkeeping and AI tools.

Paraguay Tax Residency Complete Guide 2025

How to get Paraguay tax residency, temporary and permanent residence in Paraguay in 2025 as a digital nomad or expat, a complete fiscal and immigration guide.